Transition from the micro-BA scheme to the real scheme

The switch from the micro-agricultural profit regime to the actual regime requires careful preparation and the collection of all supporting documents, which will serve as the basis for future accounting balance sheets.

Summary

This transition can be voluntary, following an option for the actual regime, or mandatory in case of exceeding the revenue threshold or change of corporate form. The change of tax regime takes effect on January 1st.

Tax period

Under the micro-BA regime, the tax period is the calendar year. The first fiscal year under the actual regime begins on January 1st, and the farmer can then freely choose their accounting closing date.

Fixed assets

- Non-depreciable fixed assets, such as land, are recorded on the balance sheet at their original value.

- Depreciable fixed assets are recorded on the opening balance sheet at their net book value, calculated based on the remaining useful life of the asset.

- Proof of the original value can be provided by any means (invoices, etc.).

- For the professional capital gains regime, the acquisition date of the asset is retained, not its date of entry on the opening balance sheet under the actual regime.

Inventory

- Inventory is valued at cost price on the opening balance sheet, with the possibility to take into account the market price if it is lower.

- Advances to crops are recorded at their cost price on the first opening balance sheet under the actual regime, then revalued during subsequent inventories.

Receivables and payables

- Receivables acquired but not yet collected at the opening of the first actual balance sheet are recorded at their value on the date of the regime change.

- Receivables arising under the micro-BA regime are taxed in the first actual fiscal year according to micro-BA rules (13%), even if not yet collected.

- There is no restatement of payables recorded on the opening balance sheet of the first actual fiscal year.

- Equipment subsidies: Equipment subsidies granted under the micro-BA regime are not taken into account for determining the actual tax regime.

- Filing obligations: The operator must attach to their first actual declaration several documents, including a copy of the opening balance sheet, tables detailing fixed assets, and a note on the valuation of inventory and advances to crops.

Context

Individual operators, agricultural companies formed before 1997, GAECs, and single-member EARLs subject to micro-BA are taxed based on all their receipts collected during the calendar year, after a flat-rate deduction of 87%.

The threshold for switching to the actual regime is set at €91,900 (excluding GAEC transparency) for 2023, based on the average of the three previous years' VAT-excluded receipts (i.e., 2020, 2021, and 2022).

The 2024 Finance Act, adopted on 12/19/2023, exceptionally raises this threshold to €120,000 for the application of the micro regime in 2024 and 2025.

In practice, the micro-BA regime would apply by right in 2024 to operators whose average VAT-excluded receipts for 2021, 2022, and 2023 do not exceed the €120,000 threshold.

The next revaluation is scheduled for 2026.

The switch from the micro-BA regime to the actual BA regime will occur:

- in case of exceeding the threshold for being subject to an actual regime,

- change of operating form to a structure subject to the actual regime by right,

- option exercised for the actual regime.

Operators and agricultural companies are then subject to the actual regime and their taxable result is determined based on their accrued receivables and confirmed payables. It is necessary to switch from cash accounting to accrual accounting.

This shift from the micro regime to an actual regime raises questions about the determination of the tax period, the valuation of fixed assets and inventory, the consideration of receivables and payables, and finally the filing obligations to be met.

Tax period

The tax period for operators under micro-BA corresponds to the calendar year, whereas taxation under an actual regime can be shifted. The opening date of the first fiscal year under an actual regime will be January 1st. The farmer can then freely choose their accounting closing date, with at least a provisional result on December 31 of the first year.

Fixed assets

Non-depreciable fixed assets

Non-depreciable fixed assets (such as land) must be recorded on the balance sheet at their original value.

Depreciable fixed assets

Depreciable fixed assets must be recorded on the opening balance sheet at their net book value, determined based on the remaining useful life of the asset, considered on the date of the switch to the actual regime.

Example

Consider a building paid in year N, €280,000, designed for normal use over 20 years. On January 1, N+10, the date on which the operator is taxed for the first time under the actual profit regime, the building is still usable for 15 years.

The useful life assessed at this same date is 25 years (10 years + 15 years) and not 20 years as initially planned.

Its net book value is: €280,000 × (15 / 25) = €168,000. It is provided that if the net book value is higher than the market value, the latter must be recorded.

Proof of the original value can be provided by any means (invoices, supplier catalogs...).

Note that for the professional capital gains regime, when the asset was acquired under the micro regime, the acquisition date of the asset must be retained and not its date of entry on the opening balance sheet under the actual regime.

Inventory

Valuation on the opening balance sheet

Items on the opening balance sheet must be valued at cost price, subject to taking into account the market price when it is lower than the cost price.

Whatever method is applied, no modification can subsequently be made to the value of the initial inventory items as long as they appear as assets on the balance sheet. In case of a subsequent loss in value of said inventory, the operator can however record a provision for depreciation.

Advances to crops

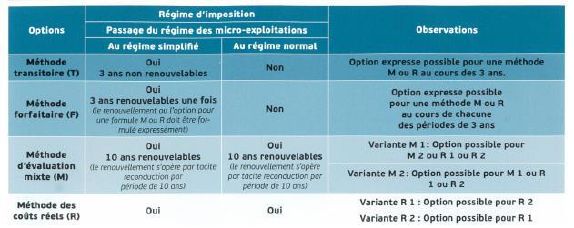

Regarding advances to crops, they are recorded at their cost price on the first opening balance sheet under the actual regime, then revalued during each subsequent inventory. Advances to crops can be valued according to different methods, which vary depending on the applicable actual regime.

Valuation of receivables and payables

Receivables

Receivables acquired by the operator but not yet collected at the date of the opening of the first actual balance sheet must be recorded at their value on the date of the regime change (nominal value or probable repayment value if it is lower than the original value).

They are added to the taxable profit of the same fiscal year for their VAT-excluded amount after a deduction of 87%. Thus, receivables arising under the micro-BA regime are taxed in the first actual fiscal year (regardless of their collection) according to micro-BA rules, i.e., at 13%. This provision applies to switches to the actual regime made from 2020 onwards.

Example: Consider an operator who switches to the actual regime on January 1, year N. The amount of their receivables on that date is €20,000. The first actual result is €30,000 to which must be added: €20,000 × 0.13 = €2,600 corresponding to the 13% taxable receivables.

Payables

There is no corresponding restatement of payables recorded on the opening balance sheet of the first actual fiscal year. This is logical, as the 87% deduction applied to the taxation of receivables includes payables.

Equipment subsidies

Equipment subsidies granted under the micro-BA regime are not to be considered for determining the actual tax regime.

Filing obligations

The operator must attach to their first actual declaration, in addition to the documents that all farmers must attach, the following documents:

- a copy of the opening balance sheet;

- tables presenting for each fixed asset: the year or, failing that, the acquisition period as well as the purchase or cost price and for each depreciable asset, the net book value remaining to be depreciated and the remaining useful life;

- a note detailing the composition and valuation method of the initial inventory. The same applies to advances to crops.

References

La version initiale de cet article a été rédigée par Aurélie Brunet.

Instruction of July 1, 2020, on the modalities of tax regime change with switch from micro BA to actual regime